In search of the best same day loans? Relax! You’ve come to the right place. In this blog post, we’ll discuss the best same day loans in 2023. We’ll provide you with a few tips on how to find the best loan for your needs, and we’ll also recommend a few lenders that loan.

So, what are you waiting for? Read on to learn more on this topic in 2023!

So, what are you waiting for? Read on to learn more on this topic in 2023!

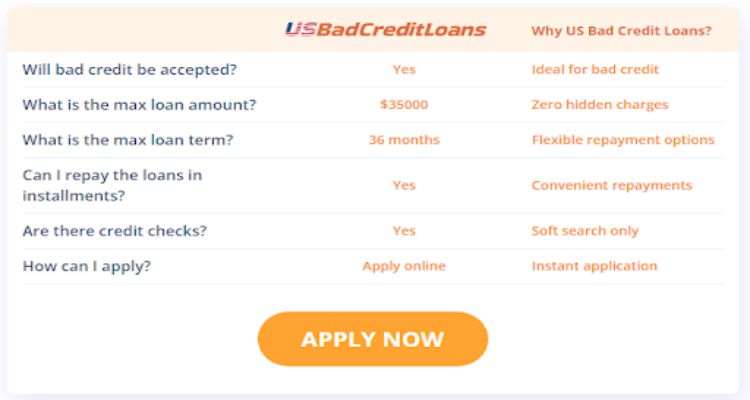

When it comes to finding a great same day loan, it’s important to do your research. There are a number of lenders out there like those on US Bad Credit Loans that offer same day loans. In that case, it’s important to compare rates and terms before you decide on a loan.

Table of Contents

Here are a few tips to help you find the best same day loan:

- Compare interest rates and terms.

Make sure to compare interest rates and terms before you decide on a loan.

- Check the lender’s eligibility requirements.

Not all lenders offer same day loans to everyone. Some lenders have eligibility requirements, so be sure to check them before you apply.

- Read the lender’s terms and conditions.

You need to read the lender’s terms and conditions before you apply for a loan. It helps you to understand the loan’s requirements and restrictions.

Now that you know how to find the best same day loan, let’s take a look at a few lenders that offer this type of loan.

The first lender we’ll recommend is Lending Club. Lending Club is a well-known lender that offers same day loans to borrowers who meet its eligibility requirements. The lender has a simple application process, and it offers competitive interest rates and terms.

Another lender that offers same day loans is Rise. Rise is a direct lender that offers loans to borrowers who meet its eligibility requirements. The lender has a simple application process, and it offers competitive interest rates and terms.

So, what are you waiting for? Apply for a same day loan online today via US Bad Credit Loans.

What Should I Know About The Best Same Day Loans

When you need money fast, this type of loan might be the answer. These loans help you to cover unexpected expenses or get cash for an emergency.

Here are some things you should know:

Here are some things you should know:

- You can get a same day loan from a variety of sources, including banks, credit unions, and online lenders.

- The interest rates and terms for same day loans vary, so shop around to find the best deal.

- You have to repay the loan on time. Missing a payment can lead to penalties and additional fees.

- Be sure to read the conditions and terms of the loan agreement carefully.

- If you have questions or concerns, contact the lender before you sign anything.

This type of loan from brokers like US Bad Credit Loans can be a great solution when you need money quickly. Just be sure to research your options and compare interest rates so you can find the best deal. And always be sure to understand the conditions and terms of any loan agreement before you sign.

How To Apply For Same Day Loans

When you’re in a financial bind, it can be tough to know where to turn. One option that you might not have considered is a same day loan. This type of loan can get the money you need quickly, without having to go through a lot of hassle. If you’re thinking about applying for this loan, here are a few things you need to know.

First, you’ll need to find a lender that offers same day loans. There are a number of lenders out there that offer this type of loan, so you shouldn’t have too much trouble finding one.

Once you’ve found a lender, you’ll need to provide some basic information. This includes your name, address, and contact information. You’ll also need to provide information about your income and your employment status.

The lender will then review your information and decide if you’re eligible for a loan. If you are, the lender will likely provide you with a loan agreement. You’ll need to sign this agreement and return it to the lender.

Once the lender receives your signed agreement, they will deposit the money into your bank account. This process usually happens very quickly, so you can expect to have the money in your account within a day or two.

If you’re in need of quick cash, a same day loan might be the right option for you. Just be sure to research the lenders before you apply.

Tips To Choose The Best Same Day Loans

When you are in a hurry and need cash immediately, same day loans can be an excellent option. However, it’s important to choose a loan that is right for your needs. Here are a few tips to help you select the best same day loan for your situation:

- Consider your credit score.

Not all same day loans are created equal. Some lenders may require a higher credit score than others. If you have bad credit or no credit, you may need to look for a lender that specializes in bad credit loans.

- Consider the interest rate.

The interest rate on a same day loan can vary significantly, so be sure to compare rates before you choose a lender.

- Consider the fees.

Some lenders may charge an origination fee or other fees. So, you need to be aware of all fees before you sign up for a loan.

- Consider the terms.

Be sure to read the conditions and terms of any loan before you agree to it. You want to be sure that you can afford the monthly payments and that there are no hidden fees.

When choosing a same day loan, it’s important to consider your needs and your credit score. By comparing interest rates and fees, you can find the best loan for your situation.

What Is The Repayment Period

These types of loans are a popular way to get cash quickly. The application process is simple, and you can often have the money you need in your account on the same day.

But what is the repayment period for this loan? Loans have a repayment period of between 14 and 30 days. This means that you have a set amount of time to pay back the loan, plus interest and any other fees. If you cannot repay the loan within the specified time period, you may be charged additional fees.

If you need cash quickly and can afford to repay the loan within the designated time period, a same-day loan may be the right option for you. Just be sure to carefully read the conditions and terms before you apply.