Table of Contents

Introduction

Personal loans can provide access to critical financing for major purchases or expenses. But they should be used responsibly. A personal loan is an unsecured, collateral-free option that assists individuals in securing funds for unexpected expenses. Be it for medical emergencies or tuition fees, personal loans help them meet their goals.

Because there is no need for applicants to submit collateral, they should keep in mind that lenders will evaluate their financial position. An individual’s capability to repay is crucial before loan approval.

The application process also has its fair share of pitfalls. By understanding the dos and don’ts, you can set yourself up for loan approval. At the same time, you can avoid mistakes that may harm your financial standing.

Dos of Applying for Personal Loans

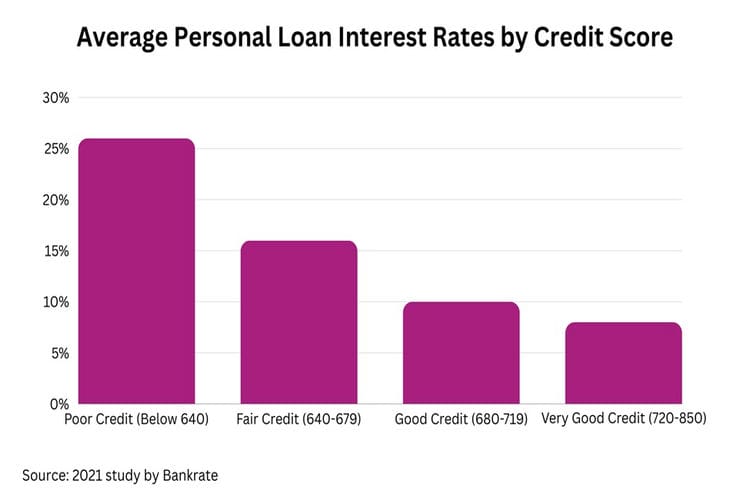

When applying for a personal loan, the right preparations and actions during the process can make a big difference. As the average FICO credit score in the U.S. sits at 718 in 2023, it’s important to understand your credit standing. Shopping around between lenders and loans can also save well over $1,500 in interest charges over the lifetime of the loan. 22% of Americans lack emergency savings. Thus, mapping out detailed monthly budgets and repayment plans is also essential.

A key initial step is to check your chances of approval beforehand. Use a personal loan pre-qualification tool to get estimates without affecting your credit score. It is a useful piece of software to have, so you’ll know if you’re qualified before applying for a personal loan. Since personal loans are necessary for major purchases, knowing your qualifications beforehand is important. Users can plan for their loans several steps ahead, addressing their credit scores and qualifications before making a purchase.

Improving Your Odds of Approval

Personal loans are a good way to consolidate debt, pay for home renovations, and more. But it’s all the more reason to use them wisely. You can take proactive steps to enhance your chances of securing approval for affordable loan terms.

Check credit reports from all three bureaus for accuracy

Review the details closely to spot and dispute any errors dragging down your score. Pay down revolving card balances below 30% of the limit. Otherwise, you might struggle with getting an affordable interest rate from the lender.

Add positive information

Become an authorized user on a spouse or family member’s long-standing credit account. Open a new credit card or personal installment loan, keeping the balance low relative to the limit.

Allow hard checks to age

Each application triggers an inquiry, which dings scores temporarily. Spread out applications over six months so the impacts fade.

33% of Americans have at least one delinquent account on their credit reports. It is recommended to check for errors. You can improve your score through these steps. As an effect, it can open up better offers.

Provide complete paperwork

Around 35% of applications face rejection due to missing information. As such, carefully gather pay stubs, bank statements, tax forms, and all sources of income. Double and even triple-check documents for accuracy before submission.

Stay within reasonable debt-to-income levels

Experts recommend keeping your projected monthly payments below 36% of verifiable gross monthly income levels across all credit accounts. Lower ratios, such as 15-20%, further improve approval odds.

Minding the Details

During the application process itself, remain vigilant on the specifics. That way, you can prevent headaches down the line. As 60% of borrowers fail to fully grasp their loan terms, being sure to read all agreements in detail is paramount.

If anything seems unclear or concerning, don’t hesitate to seek outside advice. You can also compare the terms between other lenders for reference. Consider that over 50% of regretful borrowers wish they had done so. Maintaining clear records of all communication with your lender also safeguards your rights in the event of disputes.

Common Mistakes That Can Do More Harm Than Good

While the dos focus on proactive steps, avoiding common missteps matters just as much. Applying for multiple loans simultaneously may temporarily drag down your credit score. Failing to thoroughly research lenders leaves borrowers vulnerable. Complaints against personal loan companies exceeded 28,000 cases in 2020. Glossing over the fine print or ignoring hidden fees could saddle you with unexpected costs. This will result in more headaches down the line.

Don’ts That Directly Undermine Your Finances

Certain slip-ups during the application process can inflict even more direct damage to your finances. As late payments may lurk on your credit history for up to 7 years, missing installments is highly inadvisable. Securing loan amounts that stretch your budget too thin often backfires as well. 66% of borrowers voice regret over taking on too much debt. It is a classic case of eating more than you can chew. The consequences also extend beyond your own financial standing. Co-signing for someone else’s loan can leave you accountable for the entire borrowed amount.

What Not to Do Once Your Loan Funds Come Through

Once approval for your personal loan has been secured, maintain responsible spending. It remains vitally important. 42% of borrowers splurge on vacations, dining, and other non-essentials. Misusing your loaned capital right out of the gate defeats responsible borrowing best practices. Keep in mind that your financial circumstances or income streams remain subject to change. Thus, failing to adjust your approach accordingly tends to end poorly. Experts state that 20% of borrowers experience major financial shocks like job losses while repaying loans. Skipping or defaulting on your repayment schedule also risks harming your credit standing for years.

Frequently Asked Questions

Applicants often have lingering questions when navigating the personal loan process. Among the most common queries:

What factors most influence loan eligibility?

Your credit score, reliable income streams, and employment status hold significant sway. The average national FICO score will be 711 in 2021. As a result, building your credit history and maintaining a healthy standing are instrumental. Having steady, verifiable income from full-time work or other sources also reassures lenders of your ability. They trust that you can handle repayments.

Should I consider online lenders?

Online lenders expand your range of loan offers and terms for comparison shopping. However, interest rates from online lenders sometimes exceed more traditional banks. Checking fine print for hidden fees is also critical. Besides that, the following are also vital when selecting digital lenders:

- Verifying licenses

- Types of loans issued

- Years in business

What If My Application Gets Denied?

First, obtain your free annual credit report to check for errors dragging down your score. Paying down balances, diversifying credit mixes with lines like personal loans or cards, and allowing recent hard credit pulls to age can all slowly bolster your standing over 6+ months for reapplication. Alternatively, secured loans requiring collateral like cars also expand options.

Conclusion

Applying for personal loans should be approached carefully and deliberately to tilt outcomes in your favor while avoiding credit score blows or winding up with unaffordable repayments stretching budgets too thin. By understanding the important dos and don’ts, checking your credit standing, carefully reading agreements, thoroughly researching lender options, and borrowing responsibly within your means, personal loans can serve as invaluable financial tools rather than burdens.