Table of Contents

Introduction

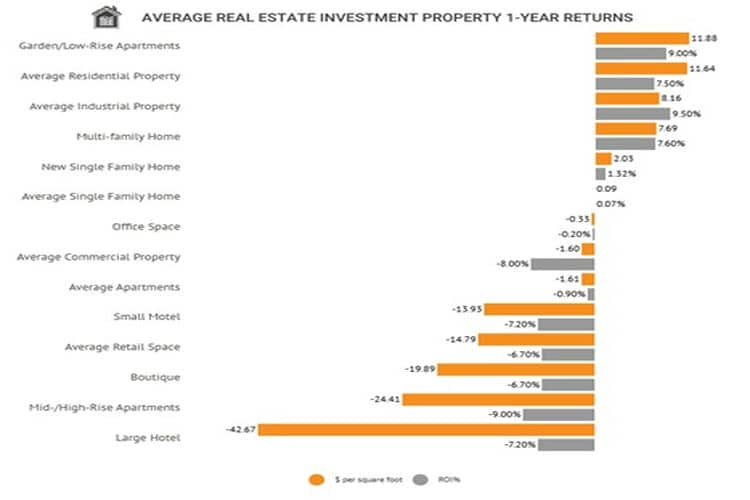

The world of real estate investment is incredibly high risk and high reward, with the potential ROI of a project constantly fluctuating due to a number of industry forces that can change at any moment. Keeping an ongoing track of the ROI of your project allows you to effectively respond to these changes and also provide consistent updates to your investors about the state of their investment and what returns they’re likely to see in their pockets. But what’s the best way to go about using these reports to track the ROI of your project? The main approach many companies are taking is to use software.

What Are Real Estate Investor Reports?

To put it simply, real estate investor reports are documents that identify the key points of an investment project that would be of interest to a real estate investor and anyone materially involved in the project. The most common types of reports are reports that cover the annual or quarterly activities of a project, however periodic reports are also frequently used. Another type of report would be a distribution notice, which identifies to an investor, how much they are going to receive in distributions. Due to the information contained in these reports, it is easy to rapidly identify the ROI of your project. Below are examples of some of the figures a routine report may include.

- Periodic income generated from your real estate project

- The periodic expenses generated by completing the project

- Any ongoing required expenses once the project has been completed

- How much investment has been generated for the project

How To Use Reporting Software to Track Your ROI

The main approach being taken by more real estate companies is to make use of specific software to maintain and generate their investor reports, which is a very effective way of tracking the ROI of your project. Real estate investing reporting tools can be used to generate a number of different reports, such as Schedule K-1s, quarterly, annual, and periodical reports and distribution notices. These systems will contain all the information about your business and your projects, which means that it can all be automatically populated when needed.

All you need to do is search for a specialist real estate investor reporting software and follow their instructions to get yourself set up on your new system. You will then be able to better track your ROI.

More Accurate Information in Reports

Because you’re able to automatically generate reports, with information that has been gathered from your own records, this makes sure that you’re actually reading the correct information about your ROI at any given time. When creating reports manually, it’s very easy for human error to creep in and create a mistake that a software approach would have avoided. It’s easier to keep a good track of your ROI when you know the figures you’re looking at are real.

The Ability To Create Reports Faster

These software platforms allow you to generate reports quickly, with a few clicks of a mouse and some platforms even have a number of templates that you can use to create a uniform report with a consistent visual theme, every single time. This also cuts down on time spent creating the visuals for each report, as you’ll have a ready-made template available to you. These reports will allow you to rapidly identify how much money your project has made, in line with your ongoing expenses without needing to mess around with spreadsheets or manual entry.

Why It’s Important To Keep Accurate Investor Reports

There are many reasons why it’s important for you to keep accurate records and investor reports, aside from just tracking your ROI. The use of real estate investor reporting software has made it easier for real estate business owners to tackle a number of different problems.

Legal and Tax Requirements

Another important point to consider about tracking your ROI using investor reports is that these figures may also be considered when you’re fulfilling your obligations to the tax authorities. When dealing with tax in general, you need to provide accurate figures; the ramifications for not doing that can be massive. Keeping your reports and your ROI calculations accurate and up to date will give you the information that you need to fulfill your obligations with very little fuss.

For Effective Decision-Making

The scope and need of a project can change massively in real estate depending on a number of factors, like material costs, accidents and investment deals falling through. Having an accurate representation of your ROI is critical to making sure that when you’re faced with tough decisions about your project, you can make the most informed choice. Well crafted reports, making use of up-to-date information, will play a massive role in the success of your project and this accuracy will prevent you from making costly mistakes. For example, if your report reflects a higher ROI than you actually have, purchases may be made that aren’t realistic in comparison to your real returns.

To Maintain Your Relationships With Investors

One of the worst things you could do when managing a project in your portfolio, is to give investors incorrect information, deliberately or accidentally. An incident like this is very likely to damage the investor’s opinion of you and make them more hesitant when working with you going forward, depending on the gravity of the mistake. For example, an incorrect report can lead to investors being underpaid when it comes time for them to have the distributions from their investment. The key to avoiding this nightmare scenario is to make sure that your reports are accurate before they’re sent out and that your ROI figures are correct.

Conclusion

Real estate investor reports are critical to ensuring that you have a good understanding of your ROI on an ongoing basis. However, the best way to maintain and generate these reports is to use a SaaS solution that amplifies the efficiency and accuracy of your reports. Otherwise, there is a material risk that certain reports may omit key information, or contain the wrong information about your ROI, which can pose a few serious problems for your real estate business. This is a large part of the reason that many real estate companies are already making use of these solutions to monitor the health of their projects.